АО "unified Pension Savings Trust"

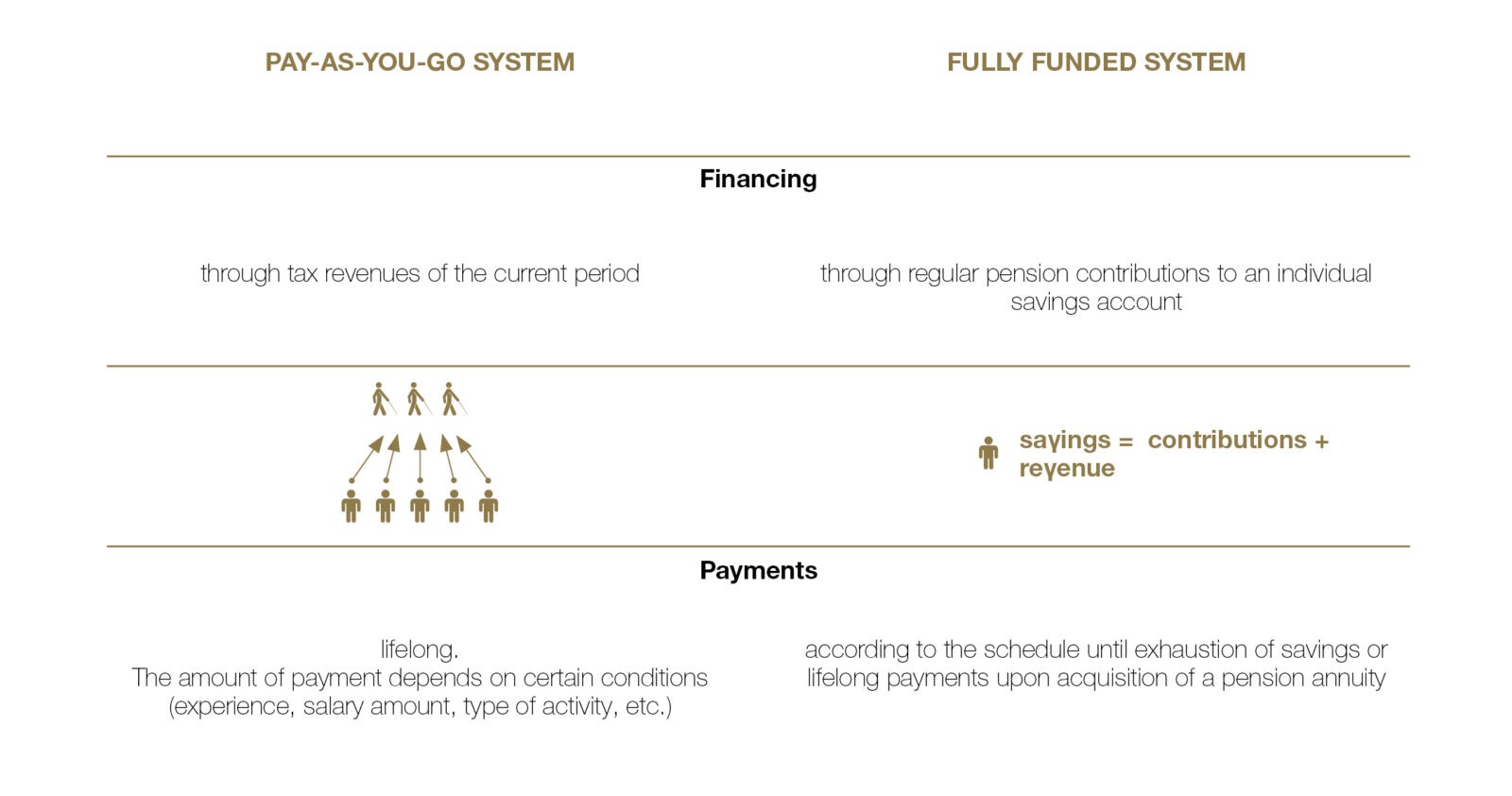

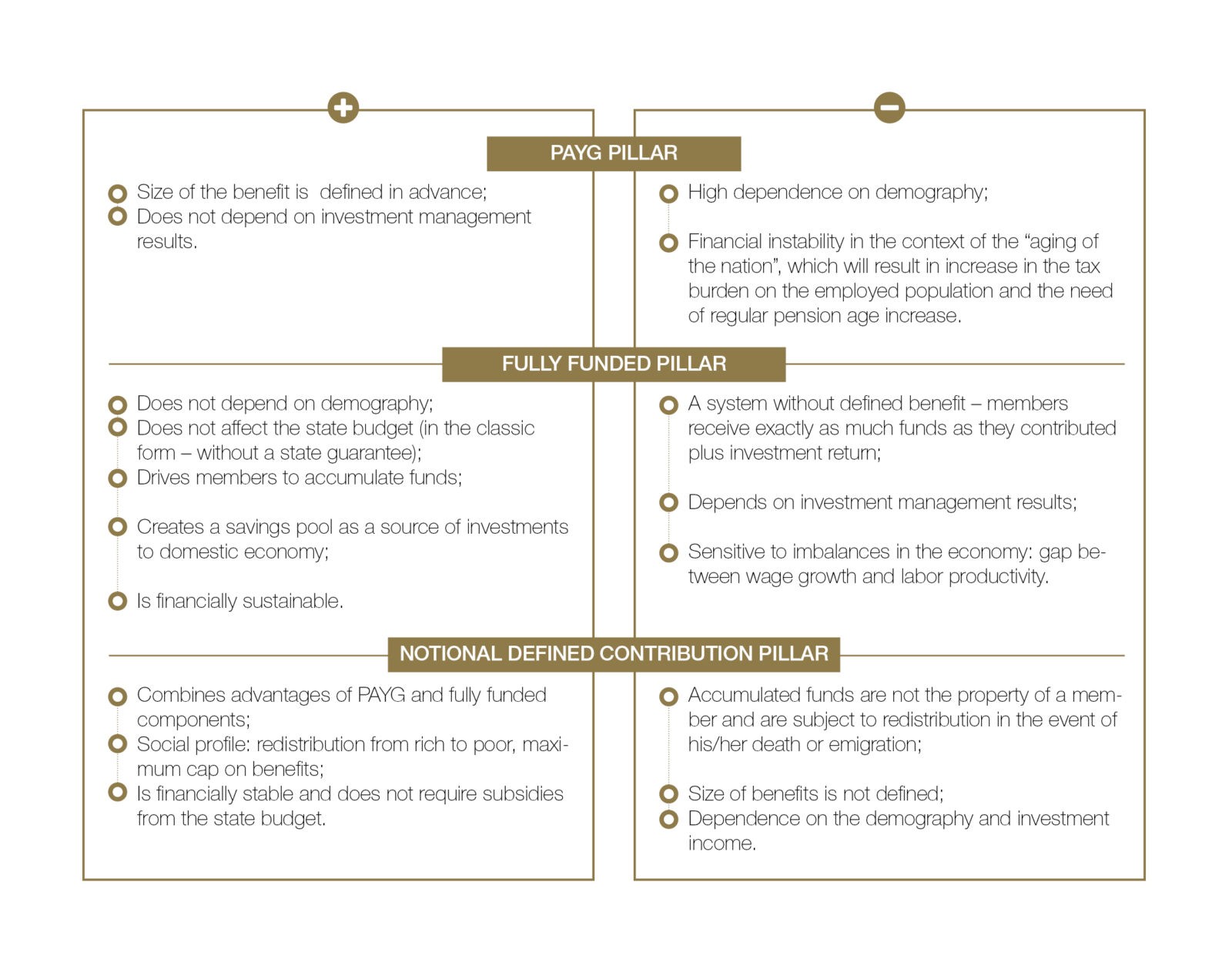

The general practice distinguishes two classical types of pension systems depending on the financing vehicle: pay-as-you-go (PAYG) and fully funded. In a PAYG pension system, pension benefits are financed by the employed population (current tax revenues). In a fully funded system, all employees make pension contributions which are not subject to redistribution among the retirees, but shall be accumulated, invested and, along with the investment income returns, eventually be paid as pension benefits to the savers.

Additionally, we can specify a notional defined contribution pension system type, implemented in a few countries, which combines the elements of both PAYG and fully funded types of pension systems. That said, the members accrue their rights to pension benefits by making contributions to the pension system. The history of incoming contributions is recorded on personal accounts, the notional savings balance may be indexed, and upon reaching retirement age, each member’s notional account balance is converted into pension annuity payments.

Review of international practice of pension systems’ design shows that countries rarely implement only one type of the system, more common practice is various combinations and even “hybrids” of classical types of the system. The latter ensures financial stability of the system, allows for higher replacement rates and mitigates the shortcomings of one component by the advantages of another.

World Bank experts involved in pension reforms in more than 80 countries also recognize advantages of multi-pillar pension systems, which, under appropriate conditions, combine some fully funded and PAYG components.

АО "unified Pension Savings Trust"

The current pension system in Kazakhstan has a multi-pillar structure. Let us recall that the Republic of Kazakhstan was the first of the Commonwealth of Independent States to implement a pension reform back in 1998. From the moment the country became independent until the pension reform in Kazakhstan, PAYG pension system inherited from the Soviet Union was in effect. The key principle of such a system is the solidarity of generations, when the earning population provides for pensioners.

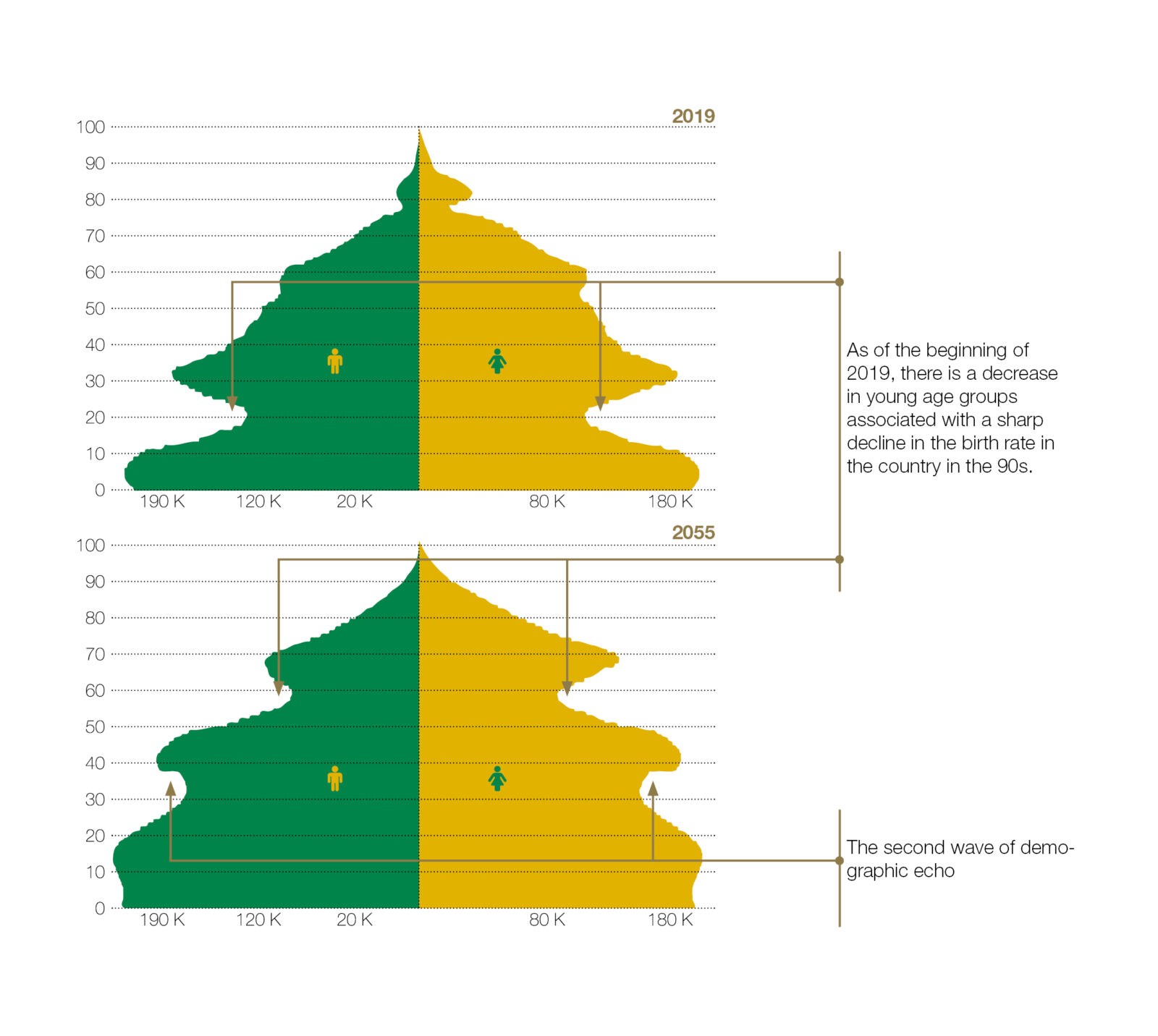

However, after the collapse of the Union, sustainability of the solidary model of the pension system deteriorated due to the economic situation of the new country. At that moment the country had a shortage of basic necessities, the majority of enterprises and manufacturers closed their businesses, people were not paid salaries and wages for months, the number of unemployed were increasing. In 1992, the country was shocked by hyperinflation, which, according to the Statistics Agency of the Republic of Kazakhstan, amounted to 2,960.8%. It became possible to control it only by 1995, when inflation was 60.3%. Besides, in most republics of the former USSR, including Kazakhstan, a decrease in the birth rate and an increase in the number of retirees was observed. We still feel the consequences of these phenomena, and we will feel them in the future, in the so-called second wave of demographic echo, when another decline in young age groups associated with a sharp decrease in birth rate in the generation of their parents takes place. However, while maintaining the current birth rates, the decrease will not be drastic.

These reasons necessitated transformation of the existing pension system: gradual transition from a social security PAYG system based on generational solidarity to a fully funded pension system. In 2018, the fully funded pension system of the Republic of Kazakhstan celebrated its 20th anniversary, which means it is halfway of its formation process. It is generally accepted that the full cycle of the system is 40 years – at least one generation goes through it.

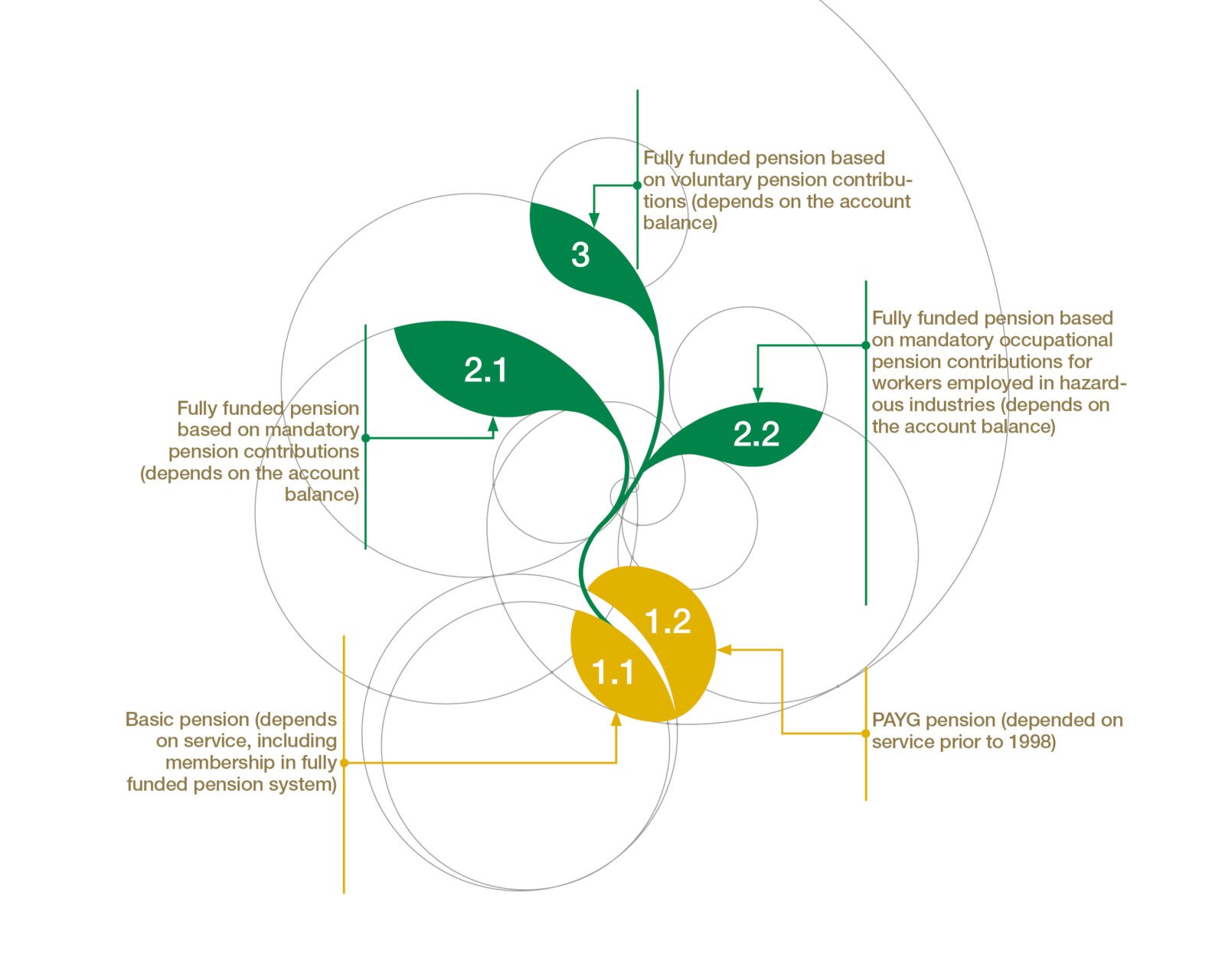

In the current situation, the principle of pension payments sources diversification (when there are several sources of pension payments in the system) allows Kazakhstan pension system to remain financially stable and provide a higher level of pension income.

The foundation of pension provision consists of the basic and PAYG pension benefits financed from the budget through tax revenues. The second pillar includes mandatory 10% employee’s contributions and mandatory occupational contributions from employers in the amount of 5% of the income of workers employed in hazardous working conditions. The third pillar consists of voluntary pension contributions.

АО "unified Pension Savings Trust"

The second and third pillars are fully funded and are formed on members’ individual pension accounts held in the Unified Accumulative Pension Fund (UAPF). However, starting from October 11, 2018, pension benefits application for withdrawals from the second pillar shall be submitted along with the application for basic and PAYG benefits in the offices of the State Corporation “Government for Citizens” in accordance with the place of residence (Public Service Center – PSC). In case of permanent I and II grades disability, a member should apply to the UAPF for second-pillar benefits withdrawals. Applications for benefits withdrawals from the third pillar are also registered with UAPF. The aggregate pension benefit, from all pillars, is as follows:

Basic pension

+

PAYG pension

+

Mandatory fully funded pension

+

Voluntary fully funded pension

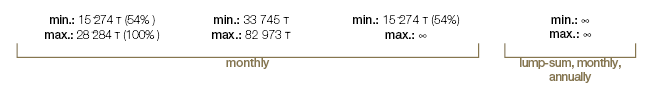

Every single retiree is entitled for a basic pension benefit; however, starting from July 1, 2018 its amount depends on the length of service prior to 1998 and the length of membership in the fully funded pension system. Thus, if a total service is 10 years or less, the basic benefit amounts to 54% of the COLA (in 2018 – 15,274 tenge), for every other year of service above 10 years, the size of the basic pension benefit shall increase by 2 pp until it reaches 100%.

PAYG pension benefit is paid to retirees with at least six months of service prior to1998. Its size depends on both the length of service and income amount. Calculation takes into account the average monthly income for any three consecutive years, regardless of interruptions in work, starting from January 1, 1995 and until retirement. For the period from January 1, 1998, the registered average monthly income is the one from which mandatory pension contributions were made to the UAPF. The maximum size pension benefit is capped at 75% of the lesser of two values: average monthly income, or 46 Monthly Calculation Indicators (in 2018 – 110,630 tenge).

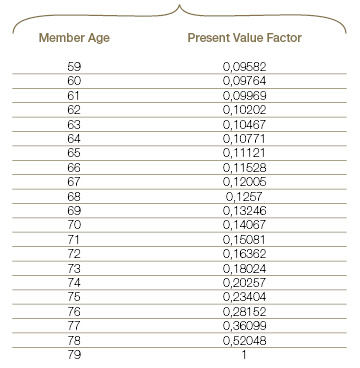

Pension benefits distributions from mandatory individual pension savings accounts at UAPF are made as monthly payments starting from January 1, 2018. However, if the account balance is less than12 Minimum Pensions (in 2018 – 404,940 tenge), then payment is made lump-sum. The size of monthly pension payment can not be lower than 54% of the COLA, and is determined in accordance with the Methodology for Calculating the Amount of Pension Benefits approved by the Decree of the Government of the Republic of Kazakhstan (No. 1042 dated 02.10.2013, as amended and supplemented as of 09.10.2018):

SAVINGS AMOUNT × PV FACTOR ÷ 12

In the event that a member did not live through to retirement, his/her heirs receive all of his/her pension savings in the UAPF as a lump-sum and in the order established by the Laws, pensions benefits from the state budget are not inherited.

Statement of the Chairman

In 2018, Kazakhstan’s fully-funded pension system celebrated its 20th anniversary. A fully-funded pension system can only be considered as mature 40 years after its inception, when at least one generation has completed a full career cycle of membership in the system, which requires making regular contributions.